Answers to the most Common South Carolina Department of Motor Vehicles Questions (SC DMV)

Doug Stockman • October 24, 2024

Not sure how to handle vehicle registration?

Understanding and complying with the regulations of the South Carolina Department of Motor Vehicles (SCDMV) is crucial to avoid fines and suspensions. Below are detailed answers to some of the most common questions related to SCDMV regulations.

Registration and License Plates

- How many days do you have to register a newly purchased vehicle in South Carolina?

Answer: You must register a newly purchased vehicle within 45 days.

- Is there a grace period for registering a vehicle in South Carolina?

Answer: Yes, residents have 30 days to renew their car tags after the expiration date. If an officer pulls you over after this period, you could be charged with a misdemeanor. Remember to cancel your insurance effective on the date you turn in the tag.

- Why did the SCDMV send me a new license plate/tag?

Answer: New plates are issued after paying county taxes at the end of the year in which your individual plate is up for reissue. In South Carolina, license plates are up for reissue every 10 years.

- Can I use my old license plate on my new car in South Carolina?

Answer: Yes, if you have a valid tag from a vehicle you sold, parked, or traded, you can transfer that tag to a new vehicle as long as the name on the new vehicle's title was also on the old vehicle's title.

Driving Without Plates and Penalties

- Can I drive a car without plates if I just bought it in South Carolina?

Answer: No. Every vehicle on South Carolina roads must have either a regular license plate or a temporary plate, which is valid for only 45 days. If you have a temporary plate, carry the bill of sale, rental contract, or title in the vehicle at all times.

- What is the penalty for not registering a vehicle in South Carolina?

Answer:

First 14 days - $10.00

15 to 30 days - $25.00

31 to 90 days - $50.00

91 days or more - $75.00

Note: The SCDMV considers the postmark date as the date of receipt when assessing penalties.

License Plate Turn-In and Transfer

- How long do you have to turn in your license plate in South Carolina?

Answer: You are required to surrender the license plate within 30 days of selling or disposing of a vehicle. You can request a refund from the Auditor's office for the unused months on the registration after you've surrendered the plate.

Note: Do not cancel your insurance until you have turned in the tag to the SC DMV.

- How do I transfer my license plate to a new car in South Carolina?

Answer: Take the registration of your previous vehicle and the bill of sale for your replacement vehicle to the DMV to register your new vehicle and perform the transfer. Be sure to contact your insurance company to make the policy change. It is the owner’s responsibility to request the change; do not rely on the dealership or lender to add your newly purchased vehicle.

- Can I throw away old license plates in South Carolina?

Answer: If your license plate is expired, it does not need to be decommissioned. Only active plates require decommissioning. You may return the plate to any SCDMV branch. Tags/plates can also be turned in or decommissioned online via the Virtual SC DMV Tag Return or Decommission.

Temporary Tags and Grace Period

- How long can you drive on a bill of sale in South Carolina?

Answer: You have 30 days to drive with just a bill of sale until you are required to get a new tag. Ensure that you keep the bill of sale in the car and have informed your insurance company.

- Is there a grace period for tags in South Carolina?

Answer: Yes, South Carolina residents have 30 days to renew their vehicle tags after expiration. If you move from out of state, you have 45 days to transfer your vehicle's title and registration. Registration can be applied for online or in person at your local DMV. Obtain South Carolina car insurance before registering your vehicle.

We hope you find this helpful. For complete SC DMV information please click the link below:

*Based on information from the South Carolina Department of Motor Vehicles as of October 2024. Car owners should always use the most current information from the SC DMV.he body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

TL;DR: Lapsed car insurance is like forgetting your pants – awkward and potentially expensive. It happens due to forgetfulness, autopilot payment issues, moving without updating info, or the risky "winging it" approach. Consequences include fines, higher future rates, and potential financial ruin if you cause an accident uninsured. Avoid this by setting up and double-checking automatic payments, using reminders, keeping your info updated, and simply not driving uninsured. Select Source Insurance in Spartanburg can help you stay covered. Alright, buckle up, buttercups, because we're about to dive into the thrilling saga of… lapsed car insurance. Yes, I know, it's a topic that's about as exciting as watching a snail race, but trust me, the consequences can be far more dramatic. Here at Select Source Insurance in Spartanburg, we've seen the aftermath of lapsed policies, and let's just say, it's not a pretty picture. Lapsed Insurance: The Vehicular Equivalent of Forgetting Your Pants. Imagine this: You're cruising down the highway, windows down, hair blowing in the wind, feeling like a star in your own personal car commercial. Then, BAM! You get pulled over. The officer asks for your insurance, and you realize… you forgot to pay that bill. Your insurance is lapsed. It's like showing up to a fancy dinner party in your pajamas. Awkward and potentially expensive. Why Does Insurance Lapse Happen? (And How to Avoid It): The "I'm Too Busy Being Awesome" Excuse: Let's face it, life gets hectic. Between work, family, and trying to remember where you left your keys, paying the insurance bill can slip your mind. But trust me, your insurance company doesn't care how awesome you are. Their system is designed to process payments to maintain continuous coverage. The "I Thought It Was on Autopilot" Snafu: You set up automatic payments, thinking you're a responsible adult. But then, your card expires, or your bank account decides to play hide-and-seek with your funds. Suddenly, your insurance is gone, and you're left wondering, "Where did I go wrong?" The "I Moved and Forgot to Tell Anyone" Fiasco: You packed up your life, moved to a new address, and forgot to update your insurance information. Now, your renewal notice is sitting in a pile of junk mail at your old place, and your insurance is doing a disappearing act. The "I Thought I Could Wing It" Gamble: Some folks think they can drive without insurance. It's like playing Russian roulette with your finances. One wrong move, and you're facing fines, license suspension, and a whole lot of regret. The Consequences: It's Not Just a Slap on the Wrist (It's More Like a Slap on the Wallet): Fines and Penalties: Driving without insurance is illegal in most states. You could face hefty fines and even have your license suspended. Increased Rates: When you finally get insurance again, you'll likely pay higher premiums. Insurance companies see lapsed coverage as a red flag. It's like showing up to a job interview with a criminal record. Financial Ruin: If you get into an accident without insurance, you're on the hook for all the damages. That could mean medical bills, car repairs, and even lawsuits. It's like trying to pay for a mansion with pocket change. The "Walk of Shame": Explaining to a police officer why you have no insurance is a unique form of public humiliation. How to Avoid the Lapsed Insurance Blues: Set Up Automatic Payments (and Double-Check Them): Make sure your card is up-to-date, and your bank account is healthy. Smart Phone App: Download the Insurance company's smart phone app and set up notifications. Paperless Notices: Many companies give you the option of receiving electronic notices (except notices that are required to be mailed by law) or receiving notices in the mail. Chose the one that works best for you. Electronic or paperless notices sometimes come with a discount. Mark Your Calendar: Set reminders for your insurance renewal dates. Keep Your Information Updated: If you move or change your contact information, let your insurance company know. Don't Gamble with Your Insurance: It's not worth the risk. At Select Source Insurance, we understand that life can get crazy. But we're here to help you keep your insurance in check. We can help you set up automatic payments, find the best rates, and answer any questions you have. Because let's be honest, nobody wants to deal with the consequences of lapsed insurance. It's like a bad date that just won't end. South Carolina DMV

TL;DR: Car insurance usually doesn't cover mechanical repairs from wear and tear or aging. It's for accidents and some external events (like accidents, theft or falling trees). Think of it as covering damage to your car from incidents, not fixing internal issues. Warranties and regular maintenance are your go-to for mechanical problems. Alright, folks, let's dive into the burning question that's probably keeping you up at night, right next to "where did I leave my keys?" and "are those aliens in my attic?" That's right, we're talking about the age-old mystery: Does car insurance cover mechanical repairs? Here at Select Source Insurance, we've heard it all. From "my car spontaneously combusted due to emotional distress" to "a rogue squirrel ninja sabotaged my engine," and we're here to set the record straight, with a dash of humor to keep you from falling asleep at your keyboard. The Short Answer: Usually, No. But Let's Get Into Details. Imagine your car insurance as a superhero. It's there to save the day when you're facing a villain like a car accident, a hailstorm, or a rogue shopping cart. But when your car decides to throw a mechanical tantrum, your insurance company is more like a bewildered bystander, shrugging its shoulders and saying, "Sorry, that's not my department." Why Insurance Companies Don't Double as Mechanics (And Why It's Probably a Good Thing): They Deal in "Accidents," Not "Aging": Car insurance is designed to cover damages caused by accidents or unforeseen events. A worn-out transmission or a sputtering engine? That's just your car aging gracefully (or not so gracefully). It's like asking your doctor to fix your leaky roof; they're in different professions. They're Not Car Whisperers: Insurance companies are experts in assessing damage from collisions and natural disasters. They're not trained to diagnose why your car sounds like a bag of angry cats. Imagine your adjuster trying to figure out why your check engine light is on. It would be a comedy show. They'd Be Broke: If insurance companies covered every mechanical repair, they'd be bankrupt faster than you can say "warranty void." Think about it: every squeaky belt and rattling exhaust would lead to a claim. They'd need an army of mechanics, and your premiums would be the size of a mortgage payment. If you have towing coverage or roadside assistance (used interchangeably), most policies will cover a broke down vehicle up to 15 miles. It the tow is longer, then the insured pays the difference. What Car Insurance Does Cover (To Make You Feel Better): Accident-Related Repairs: If your car's engine is damaged in a collision, your insurance will likely cover the repairs if you have the right coverage. It's like fixing a broken leg after a skiing accident; it's a direct result of the incident. Comprehensive Coverage (Sometimes): If a tree falls on your car and damages the engine, or if your car is stolen and stripped for parts, your comprehensive coverage might kick in. But it's still about the external, non-wear and tear stuff. Acts of God (Sometimes): If a flood or a tornado damages your engine, your comprehensive coverage might cover the repairs. But again, it's about the external, unpredictable forces. What You Can Do About Those Pesky Mechanical Repairs: Get a Warranty: If you're buying a new or used car, consider getting an extended warranty. It's like having a mechanic on speed dial, but without the awkward small talk. Regular Maintenance: Keep your car in tip-top shape with regular oil changes, tune-ups, and inspections. It's like brushing your teeth; it prevents bigger problems down the road. Find a Good Mechanic: Build a relationship with a trusted mechanic who can diagnose and fix your car's problems without breaking the bank. They're your car's best friend. At Select Source Insurance, we understand that car repairs can be a headache. But we're here to help you navigate the world of car insurance and find the coverage that's right for you. And if your car does decide to throw a mechanical tantrum, we can at least offer a sympathetic ear and a good joke. Because let's face it, sometimes laughter is the best medicine (especially when your car is making weird noises).

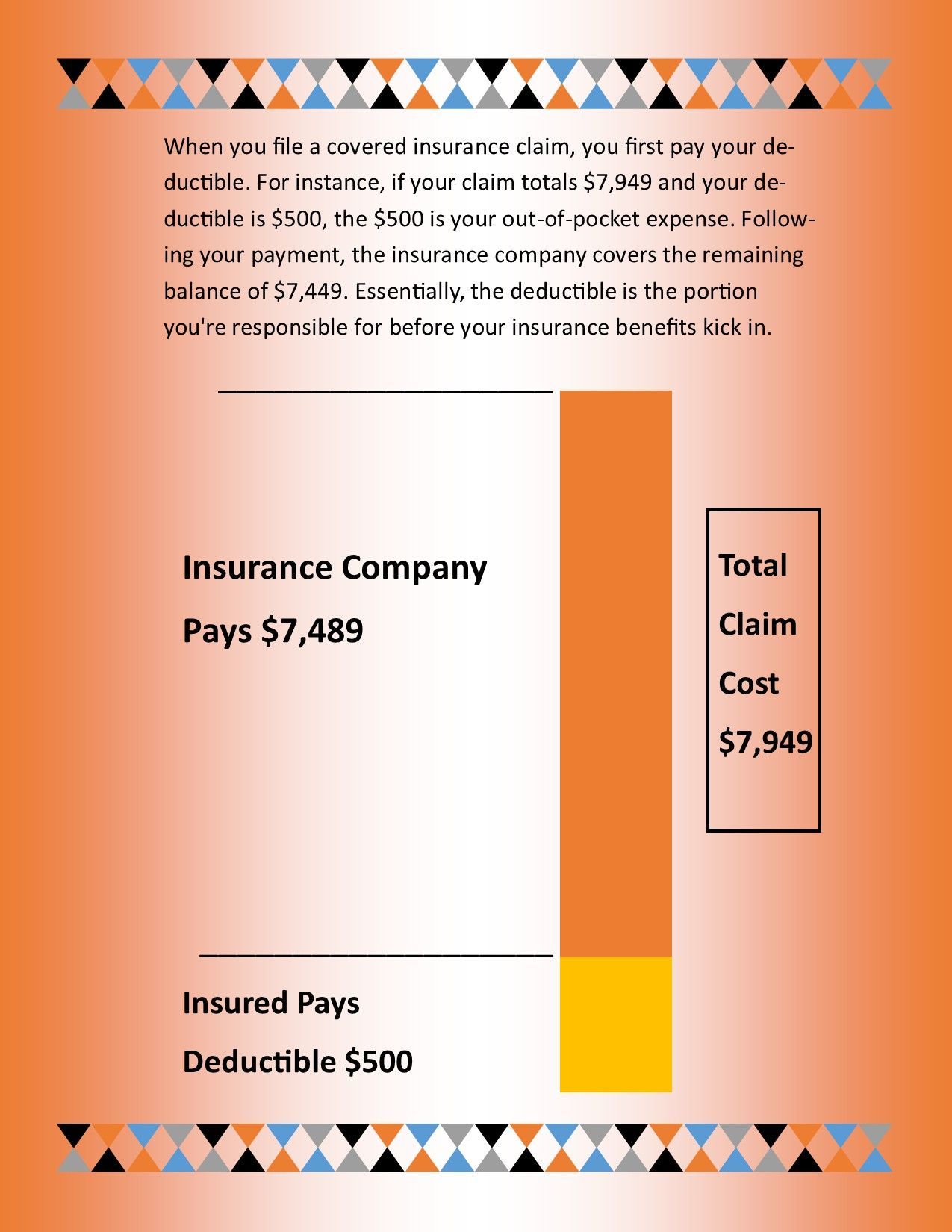

TL;DR - Quick Take Away: Car insurance deductible = the amount you pay before insurance kicks in. Low deductible = pay less upfront, higher monthly premiums. High deductible = pay more upfront, lower monthly premiums. It helps avoid small claims, keeps you invested, and offers choices. Pick the right one by considering your budget, driving, and car value. We're here to help you figure it out! Alright, folks, let's talk about the mysterious, often misunderstood creature known as the car insurance deductible. It's like the bouncer at the club of "getting your car fixed," deciding how much you pay before the party really gets started. Here at Select Source Insurance, we're here to demystify this financial gatekeeper, with a healthy dose of humor to keep you from nodding off. The Deductible: Your Insurance "Starter Fee" Imagine your car insurance as a generous friend who's always willing to help you out of a jam. But even generous friends have their limits. That's where the deductible comes in. It's the amount you agree to pay out of your own pocket before your insurance company steps in and says, "Don't worry, I got this!" Deductibles: The "You Pay a Little, They Pay a Lot" Deal Think of it like this: Low Deductible: You pay a smaller amount upfront, and your insurance company covers more of the repair costs. It's like ordering the appetizer sampler; it's a smaller initial hit, but you're still paying. High Deductible: You pay a larger amount upfront, but your insurance company rewards you with lower monthly premiums. It's like ordering the family-sized pizza; you pay more initially, but you get more bang for your buck in the long run. Why Do Deductibles Exist? (And Why They're Not Just Trying to Annoy You): To Discourage Minor Claims: Insurance companies aren't fans of small claims. It's like calling a plumber to fix a leaky faucet; it's probably cheaper to handle it yourself. Deductibles help keep insurance costs down for everyone. To Keep You Invested: When you have a deductible, you're more likely to take care of your car and drive safely. It's like having a security deposit on an apartment; you're more likely to keep the place clean. To Offer Choices: Deductibles allow you to customize your insurance policy to fit your budget and risk tolerance. It's like choosing the spice level on your takeout; you get to decide how much heat you can handle. How to Choose the Right Deductible (Without Flipping a Coin): Consider Your Budget: Can you afford to pay a higher deductible if you have a claim? If not, a lower deductible might be a better option. It's like deciding how much you can spend on a night out; know your limits. Think About Your Driving Habits: If you're a safe driver, a higher deductible might be a good choice. If you're prone to fender-benders, a lower deductible might be safer. It's like deciding whether to wear a helmet while riding a bike; it depends on your risk level. Don't Forget About Your Car's Value: If your car is older and less valuable, a higher deductible might make sense. If your car is brand new and expensive, a lower deductible might be wiser. It’s like deciding how much insurance you want on your rare collection of porcelain gnomes. The Moral of the Deductible Story: Deductibles aren't scary monsters hiding under your car. They're simply a way to balance your insurance costs and risk. And at Select Source Insurance, we're here to help you find the deductible that's just right for you. We'll explain the options, answer your questions, and make sure you understand how it all works. Because let's be honest, nobody wants to deal with insurance surprises, especially when they involve money.