How A Car Insurance Deductible Works

Doug Stockman • April 24, 2025

This is a subtitle for your new post

TL;DR - Quick Take Away:

Car insurance deductible = the amount you pay before insurance kicks in. Low deductible = pay less upfront, higher monthly premiums. High deductible = pay more upfront, lower monthly premiums. It helps avoid small claims, keeps you invested, and offers choices. Pick the right one by considering your budget, driving, and car value. We're here to help you figure it out!

The Deductible: Your Insurance "Starter Fee"

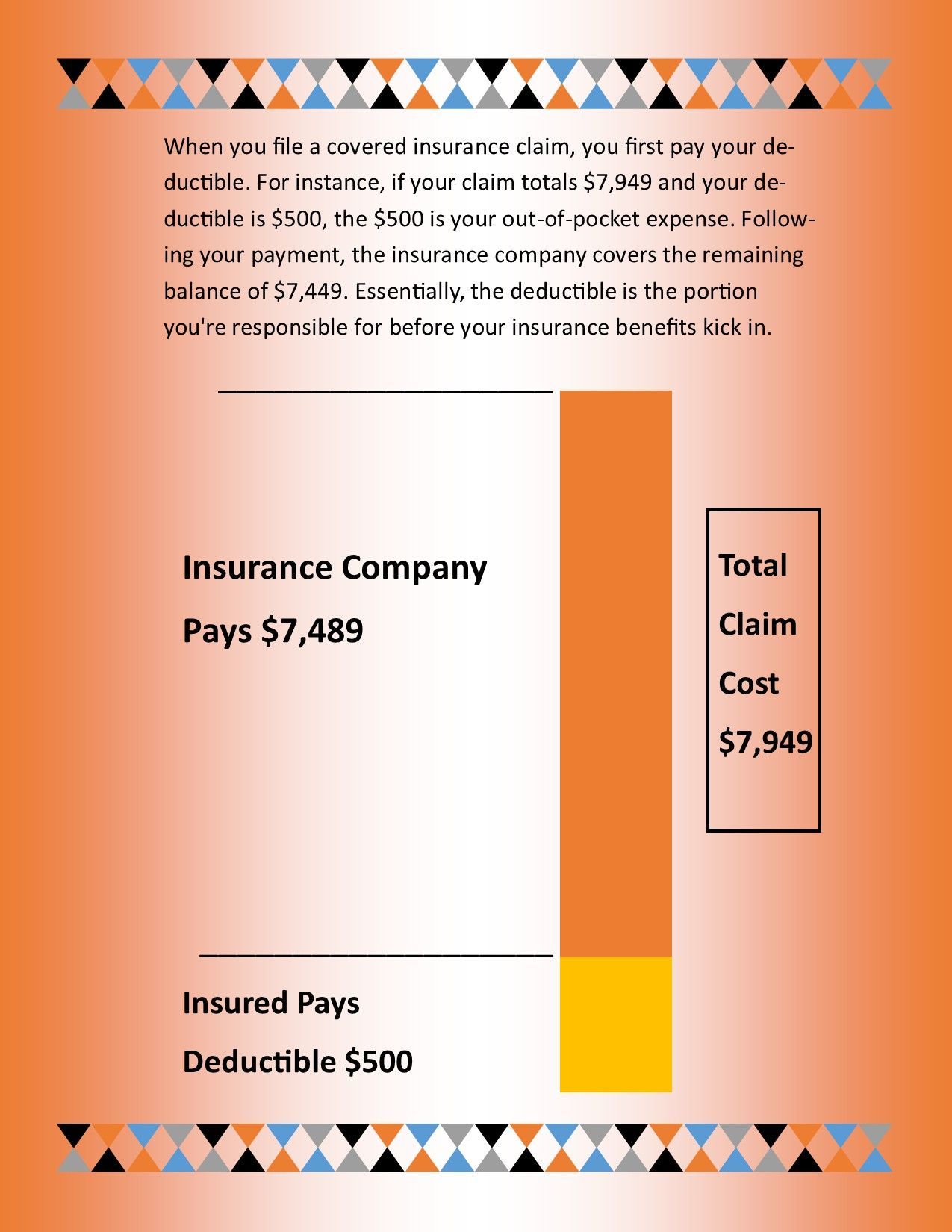

Imagine your car insurance as a generous friend who's always willing to help you out of a jam. But even generous friends have their limits. That's where the deductible comes in. It's the amount you agree to pay out of your own pocket before your insurance company steps in and says, "Don't worry, I got this!"

Deductibles: The "You Pay a Little, They Pay a Lot" Deal

Think of it like this:

Low Deductible:

You pay a smaller amount upfront, and your insurance company covers more of the repair costs. It's like ordering the appetizer sampler; it's a smaller initial hit, but you're still paying.

High Deductible: You pay a larger amount upfront, but your insurance company rewards you with lower monthly premiums. It's like ordering the family-sized pizza; you pay more initially, but you get more bang for your buck in the long run.

Why Do Deductibles Exist?

(And Why They're Not Just Trying to Annoy You):

To Discourage Minor Claims: Insurance companies aren't fans of small claims. It's like calling a plumber to fix a leaky faucet; it's probably cheaper to handle it yourself. Deductibles help keep insurance costs down for everyone.

To Keep You Invested: When you have a deductible, you're more likely to take care of your car and drive safely. It's like having a security deposit on an apartment; you're more likely to keep the place clean.

To Offer Choices: Deductibles allow you to customize your insurance policy to fit your budget and risk tolerance. It's like choosing the spice level on your takeout; you get to decide how much heat you can handle.

How to Choose the Right Deductible (Without Flipping a Coin):

Consider Your Budget: Can you afford to pay a higher deductible if you have a claim? If not, a lower deductible might be a better option. It's like deciding how much you can spend on a night out; know your limits.

Think About Your Driving Habits: If you're a safe driver, a higher deductible might be a good choice. If you're prone to fender-benders, a lower deductible might be safer. It's like deciding whether to wear a helmet while riding a bike; it depends on your risk level.

Don't Forget About Your Car's Value: If your car is older and less valuable, a higher deductible might make sense. If your car is brand new and expensive, a lower deductible might be wiser. It’s like deciding how much insurance you want on your rare collection of porcelain gnomes.

The Moral of the Deductible Story:

Deductibles aren't scary monsters hiding under your car. They're simply a way to balance your insurance costs and risk. And at Select Source Insurance, we're here to help you find the deductible that's just right for you. We'll explain the options, answer your questions, and make sure you understand how it all works. Because let's be honest, nobody wants to deal with insurance surprises, especially when they involve money.

TL;DR: Lapsed car insurance is like forgetting your pants – awkward and potentially expensive. It happens due to forgetfulness, autopilot payment issues, moving without updating info, or the risky "winging it" approach. Consequences include fines, higher future rates, and potential financial ruin if you cause an accident uninsured. Avoid this by setting up and double-checking automatic payments, using reminders, keeping your info updated, and simply not driving uninsured. Select Source Insurance in Spartanburg can help you stay covered. Alright, buckle up, buttercups, because we're about to dive into the thrilling saga of… lapsed car insurance. Yes, I know, it's a topic that's about as exciting as watching a snail race, but trust me, the consequences can be far more dramatic. Here at Select Source Insurance in Spartanburg, we've seen the aftermath of lapsed policies, and let's just say, it's not a pretty picture. Lapsed Insurance: The Vehicular Equivalent of Forgetting Your Pants. Imagine this: You're cruising down the highway, windows down, hair blowing in the wind, feeling like a star in your own personal car commercial. Then, BAM! You get pulled over. The officer asks for your insurance, and you realize… you forgot to pay that bill. Your insurance is lapsed. It's like showing up to a fancy dinner party in your pajamas. Awkward and potentially expensive. Why Does Insurance Lapse Happen? (And How to Avoid It): The "I'm Too Busy Being Awesome" Excuse: Let's face it, life gets hectic. Between work, family, and trying to remember where you left your keys, paying the insurance bill can slip your mind. But trust me, your insurance company doesn't care how awesome you are. Their system is designed to process payments to maintain continuous coverage. The "I Thought It Was on Autopilot" Snafu: You set up automatic payments, thinking you're a responsible adult. But then, your card expires, or your bank account decides to play hide-and-seek with your funds. Suddenly, your insurance is gone, and you're left wondering, "Where did I go wrong?" The "I Moved and Forgot to Tell Anyone" Fiasco: You packed up your life, moved to a new address, and forgot to update your insurance information. Now, your renewal notice is sitting in a pile of junk mail at your old place, and your insurance is doing a disappearing act. The "I Thought I Could Wing It" Gamble: Some folks think they can drive without insurance. It's like playing Russian roulette with your finances. One wrong move, and you're facing fines, license suspension, and a whole lot of regret. The Consequences: It's Not Just a Slap on the Wrist (It's More Like a Slap on the Wallet): Fines and Penalties: Driving without insurance is illegal in most states. You could face hefty fines and even have your license suspended. Increased Rates: When you finally get insurance again, you'll likely pay higher premiums. Insurance companies see lapsed coverage as a red flag. It's like showing up to a job interview with a criminal record. Financial Ruin: If you get into an accident without insurance, you're on the hook for all the damages. That could mean medical bills, car repairs, and even lawsuits. It's like trying to pay for a mansion with pocket change. The "Walk of Shame": Explaining to a police officer why you have no insurance is a unique form of public humiliation. How to Avoid the Lapsed Insurance Blues: Set Up Automatic Payments (and Double-Check Them): Make sure your card is up-to-date, and your bank account is healthy. Smart Phone App: Download the Insurance company's smart phone app and set up notifications. Paperless Notices: Many companies give you the option of receiving electronic notices (except notices that are required to be mailed by law) or receiving notices in the mail. Chose the one that works best for you. Electronic or paperless notices sometimes come with a discount. Mark Your Calendar: Set reminders for your insurance renewal dates. Keep Your Information Updated: If you move or change your contact information, let your insurance company know. Don't Gamble with Your Insurance: It's not worth the risk. At Select Source Insurance, we understand that life can get crazy. But we're here to help you keep your insurance in check. We can help you set up automatic payments, find the best rates, and answer any questions you have. Because let's be honest, nobody wants to deal with the consequences of lapsed insurance. It's like a bad date that just won't end. South Carolina DMV

TL;DR: Car insurance usually doesn't cover mechanical repairs from wear and tear or aging. It's for accidents and some external events (like accidents, theft or falling trees). Think of it as covering damage to your car from incidents, not fixing internal issues. Warranties and regular maintenance are your go-to for mechanical problems. Alright, folks, let's dive into the burning question that's probably keeping you up at night, right next to "where did I leave my keys?" and "are those aliens in my attic?" That's right, we're talking about the age-old mystery: Does car insurance cover mechanical repairs? Here at Select Source Insurance, we've heard it all. From "my car spontaneously combusted due to emotional distress" to "a rogue squirrel ninja sabotaged my engine," and we're here to set the record straight, with a dash of humor to keep you from falling asleep at your keyboard. The Short Answer: Usually, No. But Let's Get Into Details. Imagine your car insurance as a superhero. It's there to save the day when you're facing a villain like a car accident, a hailstorm, or a rogue shopping cart. But when your car decides to throw a mechanical tantrum, your insurance company is more like a bewildered bystander, shrugging its shoulders and saying, "Sorry, that's not my department." Why Insurance Companies Don't Double as Mechanics (And Why It's Probably a Good Thing): They Deal in "Accidents," Not "Aging": Car insurance is designed to cover damages caused by accidents or unforeseen events. A worn-out transmission or a sputtering engine? That's just your car aging gracefully (or not so gracefully). It's like asking your doctor to fix your leaky roof; they're in different professions. They're Not Car Whisperers: Insurance companies are experts in assessing damage from collisions and natural disasters. They're not trained to diagnose why your car sounds like a bag of angry cats. Imagine your adjuster trying to figure out why your check engine light is on. It would be a comedy show. They'd Be Broke: If insurance companies covered every mechanical repair, they'd be bankrupt faster than you can say "warranty void." Think about it: every squeaky belt and rattling exhaust would lead to a claim. They'd need an army of mechanics, and your premiums would be the size of a mortgage payment. If you have towing coverage or roadside assistance (used interchangeably), most policies will cover a broke down vehicle up to 15 miles. It the tow is longer, then the insured pays the difference. What Car Insurance Does Cover (To Make You Feel Better): Accident-Related Repairs: If your car's engine is damaged in a collision, your insurance will likely cover the repairs if you have the right coverage. It's like fixing a broken leg after a skiing accident; it's a direct result of the incident. Comprehensive Coverage (Sometimes): If a tree falls on your car and damages the engine, or if your car is stolen and stripped for parts, your comprehensive coverage might kick in. But it's still about the external, non-wear and tear stuff. Acts of God (Sometimes): If a flood or a tornado damages your engine, your comprehensive coverage might cover the repairs. But again, it's about the external, unpredictable forces. What You Can Do About Those Pesky Mechanical Repairs: Get a Warranty: If you're buying a new or used car, consider getting an extended warranty. It's like having a mechanic on speed dial, but without the awkward small talk. Regular Maintenance: Keep your car in tip-top shape with regular oil changes, tune-ups, and inspections. It's like brushing your teeth; it prevents bigger problems down the road. Find a Good Mechanic: Build a relationship with a trusted mechanic who can diagnose and fix your car's problems without breaking the bank. They're your car's best friend. At Select Source Insurance, we understand that car repairs can be a headache. But we're here to help you navigate the world of car insurance and find the coverage that's right for you. And if your car does decide to throw a mechanical tantrum, we can at least offer a sympathetic ear and a good joke. Because let's face it, sometimes laughter is the best medicine (especially when your car is making weird noises).

TL;DR: Article Take Away - Don't just get the cheapest car insurance! A client who chose higher liability limits paid a little more monthly but avoided a $137,387 bill after causing a big accident. Investing in good coverage protects you financially when things go wrong. Talk to your agent about your options! Dodging a Huge Bill: How My Clie nt Became a Liability Limit Hero (and You Can Too!) Hey everyone, sit down, grab your drink, and let me tell you a cool story. It's about how one of my clients made a really smart choice with his car insurance and avoided a huge money problem! It all came down to something called good liability limits compared to state minimum limits. Now, I know what you might be thinking. "Insurance? Yawn! Just give me the cheapest one so I can watch more funny cat videos." And I get it! We all love a good deal, and saving money feels great. But when it comes to car insurance, skimping on coverage is like playing Russian Roulette with your bank account and other assets. If you don't have a high enough limit, you could end up paying out of pocket for damage you caused to someone else. Just because you have insurance doesn't release you for being responsible for ALL the damages. Investing in the right coverage is one of the smartest things you can do for your peace of mind and your wallet. Let me tell you about a guy we'll call Marcus. Marcus was looking for car insurance and, like many of us, he was hoping for the lowest price each month. He was looking at a plan that cost less than a cheap hotdog (and wouldn't have offered much protection at all!). Now, having the right agent can make all the difference in the world. I knew Marcus could be better protected. So, I didn't just give him the cheapest thing and say "bye-bye." We talked a bit. We had a friendly "let's-think-ahead" chat. I explained that while a low monthly cost might seem great at first, the amount his insurance would pay if he caused an accident was really low. It might not even cover a small crash. It's all about having enough protection for those unexpected moments. Have you bought a car recently? Have you noticed skyrocketing repairs and medical costs? "But I'm a good driver!" Marcus said, like a lot of people do. And maybe Marcus is a super good driver – that's fantastic! But you know what they say: stuff happens! Sometimes, even the best drivers can be in a situation where someone else makes a mistake, like texting and driving a large vehicle when you're nearby. So, I showed Marcus different choices. We talked about how much his insurance would pay if he accidentally hurt someone or damaged their stuff. I really encouraged him to get more coverage. Not because I want to buy a lot of avocado toast (even though I do!), but because it's the smart and safe thing to do with your money. Think of it as investing in your future security. It's like wearing a helmet when you ride a bike on a rope over hungry crocodiles – a little extra protection can make a huge difference! Marcus was smart and thoughtful. He listened to what I said and realized the value of having better coverage. He decided to pay a little more each month to get much better protection (and it wasn't that much more). This was a really positive step for him! A few months later, guess what? Something bad happened. Not a monster truck, thankfully, but a pretty big car crash with a lot of cars. Marcus was responsible for paying for some of the damage to other cars and some people getting hurt. This is where Marcus' wise decision really paid off. Now for the exciting part! The first guesses for how much all the damage and doctor bills would cost were HUGE. Like, "make a lottery winner nervous" huge. It was a really serious situation. But because Marcus had listened and bought the higher limit insurance, his insurance company paid for almost all of it! What a relief! How much money did Marcus almost have to pay out of his own pocket if he had bought the cheap state minimum or other low liability insurance? A whopping $137,387. That's a life-changing amount of money! Think about that! One hundred and thirty-seven thousand, three hundred and eighty-seven dollars! That could be a down payment on a small castle, a lifetime of fancy coffee, or just really cause a lot of financial stress. And the extra insurance only cost less than $30/mo. Instead, Marcus just had to deal with the insurance claim (which was still a bit annoying, but not a disaster). He didn't have to sell his house, create a GoFundMe account, ask for the church offering plate to be passed, or spend years paying off bills. He was protected! So, the point of this story is: accidents are no fun, and we all hope they never happen. But being prepared with the right insurance can make a huge difference in how you handle those unexpected moments. The limits on your policy is all it is going to pay. If the damages are more, it has to come from somewhere. Choosing the right coverage isn't about spending more, it's about making a smart investment in your future security. Car insurance isn't just something you have to get. It's something that really protects your future money and gives you peace of mind. Those limits on how much your insurance will pay? They're like your shield against bad things happening on the road. Having good liability limits is like having a strong safety net. So, do yourself a favor. Don't just look at the price each month. Talk to your friendly, independent insurance agent at Select Source Insurance. We're here to help you understand your options and make the best choice for you. Understand how much protection you're getting. Think about what could go wrong. And please, make a wise choice now so you don't face a big financial worry later. You might not end up saving exactly $137,387, but knowing you're covered well? That feeling of security is truly priceless. Now, if you'll excuse me, I'm suddenly really hungry for avocado toast. It's just part of the job!