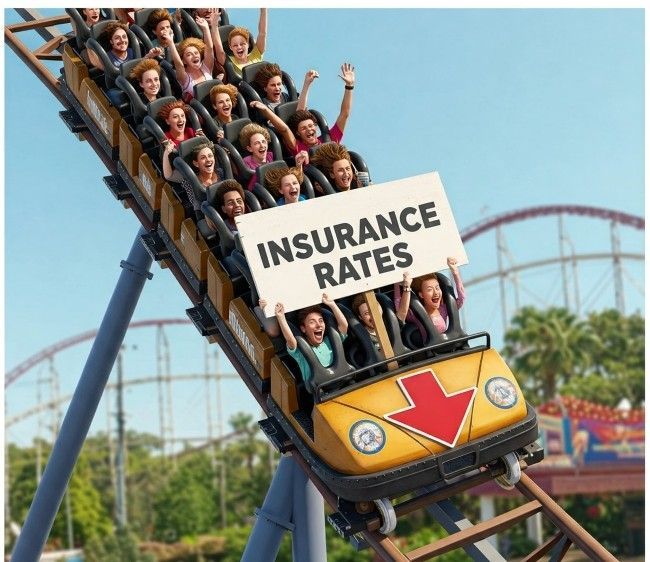

Will Car Insurance Rates Go Down?

Doug Stockman • April 8, 2025

What can you do to help lower your rates?

TL;DR

- Current Trends: Insurance costs are rising due to distracted driving, expensive car technology, inflation, and extreme weather.

- Potential Reductions: Self-driving cars, improved safety tech, and good driving habits could lower costs in the future.

- Reality Check: Don't expect dramatic price drops soon.

- Actionable Advice: Get Quotes from independent insurance agencies and ask about discounts.

- Agency Recommendation: Regularly review your policy and consider an independent agency to compare rates.

The Great Car Insurance Descent: Will It Ever Happen? (Spoiler: We Need More Unicorns)

Ah, car insurance. That ever-present financial companion, like a slightly judgmental friend who constantly reminds you of your potential for vehicular mayhem. We all dream of that magical day: "Car insurance rates… plunging!" But is it a dream, or a distant, fuel-efficient reality? Let's explore this with a wink and a nod.

The Upward Trend: A Comedy of Errors

First, let's acknowledge the elephant in the rearview mirror: car insurance rates have been doing a stellar impression of a rocket launch. Why? Well, it's a multi-act play:

Distracted Driving:

The Modern-Day Joust: We're battling our phones, our snacks, and the existential dread of rush hour. Insurance companies see this as a high-stakes, low-skill jousting tournament. In the Spartanburg South Carolina and surrounding areas there is also the problem of following too close. Check out this article on the "3 Second Rule".

Technology:

The Double-Edged Sword: Cars are smarter, but repairs are pricier. A fender bender can now involve replacing a computer chip that costs more than your first car. Also, windshields now have the sensors for emergency braking or early lane departure warning. According to our local glass repair shops, the cost to replace a windshield has doubled and tripled.

Inflation:

The Uninvited Guest: Everything's more expensive, including medical bills and car parts. Insurance companies aren't immune to this, sadly. There is also the delay, here in the upstate, caused by body repair shops not being able to keep up with demand. A customer recently had to wait 40 days before the repair shop could start the repair.

Weather:

Mother Nature's Demolition Derby: Hailstorms, floods, and the occasional rogue tornado are turning cars into abstract art. Insurance companies are footing the bill.

The Hopeful Horizon:

A Comedy of (Potential) Wins. There is light at the end of the tunnel (and it's not an oncoming train)!

Now, let's inject some optimism, shall we? There are a few scenarios where your premiums might take a chill pill:

Autonomous Vehicles:

The Robotic Revolution (Maybe): If self-driving cars become the norm, accidents should decrease. But we're still waiting on those robot overlords to prove they can parallel park. They may work in mild weather climates, but I don't see how they can work on snow packed roads.

Improved Safety Technology:

The Guardian Angels of the Road: Advanced safety features like automatic braking and lane departure warnings are making roads safer. If this trend continues, insurers might reward us.

You:

The Model Citizen: A clean driving record, a good credit score, and bundling your policies? You're basically a superhero in the eyes of insurance companies.

The Bottom Line:

Don't Hold Your Breath (But do check with your local independent insurance agent like Select Source Insurance)

Will car insurance go down? Maybe, someday, when unicorns roam free, and traffic jams turn into synchronized dance numbers. Until then:

Shop around:

Independent agencies (like us!) can compare rates from multiple insurers. Car Insurance Quote

Drive safely:

Be the hero your insurance company deserves. Watch 3 Second Rule by Travelers Insurance

Ask about discounts:

You might be surprised at what you qualify for.

Regularly review your coverage:

Life changes, and so should your insurance.

In conclusion, while we can't predict the future, we can control our own driving habits and insurance choices. So, drive safe, shop smart, and keep dreaming of those mythical low premiums. And if you see a unicorn, tell it to talk to your insurance agent.

TL;DR: Article Take Away - Don't just get the cheapest car insurance! A client who chose higher liability limits paid a little more monthly but avoided a $137,387 bill after causing a big accident. Investing in good coverage protects you financially when things go wrong. Talk to your agent about your options! Dodging a Huge Bill: How My Clie nt Became a Liability Limit Hero (and You Can Too!) Hey everyone, sit down, grab your drink, and let me tell you a cool story. It's about how one of my clients made a really smart choice with his car insurance and avoided a huge money problem! It all came down to something called good liability limits compared to state minimum limits. Now, I know what you might be thinking. "Insurance? Yawn! Just give me the cheapest one so I can watch more funny cat videos." And I get it! We all love a good deal, and saving money feels great. But when it comes to car insurance, skimping on coverage is like playing Russian Roulette with your bank account and other assets. If you don't have a high enough limit, you could end up paying out of pocket for damage you caused to someone else. Just because you have insurance doesn't release you for being responsible for ALL the damages. Investing in the right coverage is one of the smartest things you can do for your peace of mind and your wallet. Let me tell you about a guy we'll call Marcus. Marcus was looking for car insurance and, like many of us, he was hoping for the lowest price each month. He was looking at a plan that cost less than a cheap hotdog (and wouldn't have offered much protection at all!). Now, having the right agent can make all the difference in the world. I knew Marcus could be better protected. So, I didn't just give him the cheapest thing and say "bye-bye." We talked a bit. We had a friendly "let's-think-ahead" chat. I explained that while a low monthly cost might seem great at first, the amount his insurance would pay if he caused an accident was really low. It might not even cover a small crash. It's all about having enough protection for those unexpected moments. Have you bought a car recently? Have you noticed skyrocketing repairs and medical costs? "But I'm a good driver!" Marcus said, like a lot of people do. And maybe Marcus is a super good driver – that's fantastic! But you know what they say: stuff happens! Sometimes, even the best drivers can be in a situation where someone else makes a mistake, like texting and driving a large vehicle when you're nearby. So, I showed Marcus different choices. We talked about how much his insurance would pay if he accidentally hurt someone or damaged their stuff. I really encouraged him to get more coverage. Not because I want to buy a lot of avocado toast (even though I do!), but because it's the smart and safe thing to do with your money. Think of it as investing in your future security. It's like wearing a helmet when you ride a bike on a rope over hungry crocodiles – a little extra protection can make a huge difference! Marcus was smart and thoughtful. He listened to what I said and realized the value of having better coverage. He decided to pay a little more each month to get much better protection (and it wasn't that much more). This was a really positive step for him! A few months later, guess what? Something bad happened. Not a monster truck, thankfully, but a pretty big car crash with a lot of cars. Marcus was responsible for paying for some of the damage to other cars and some people getting hurt. This is where Marcus' wise decision really paid off. Now for the exciting part! The first guesses for how much all the damage and doctor bills would cost were HUGE. Like, "make a lottery winner nervous" huge. It was a really serious situation. But because Marcus had listened and bought the higher limit insurance, his insurance company paid for almost all of it! What a relief! How much money did Marcus almost have to pay out of his own pocket if he had bought the cheap state minimum or other low liability insurance? A whopping $137,387. That's a life-changing amount of money! Think about that! One hundred and thirty-seven thousand, three hundred and eighty-seven dollars! That could be a down payment on a small castle, a lifetime of fancy coffee, or just really cause a lot of financial stress. And the extra insurance only cost less than $30/mo. Instead, Marcus just had to deal with the insurance claim (which was still a bit annoying, but not a disaster). He didn't have to sell his house, create a GoFundMe account, ask for the church offering plate to be passed, or spend years paying off bills. He was protected! So, the point of this story is: accidents are no fun, and we all hope they never happen. But being prepared with the right insurance can make a huge difference in how you handle those unexpected moments. The limits on your policy is all it is going to pay. If the damages are more, it has to come from somewhere. Choosing the right coverage isn't about spending more, it's about making a smart investment in your future security. Car insurance isn't just something you have to get. It's something that really protects your future money and gives you peace of mind. Those limits on how much your insurance will pay? They're like your shield against bad things happening on the road. Having good liability limits is like having a strong safety net. So, do yourself a favor. Don't just look at the price each month. Talk to your friendly, independent insurance agent at Select Source Insurance. We're here to help you understand your options and make the best choice for you. Understand how much protection you're getting. Think about what could go wrong. And please, make a wise choice now so you don't face a big financial worry later. You might not end up saving exactly $137,387, but knowing you're covered well? That feeling of security is truly priceless. Now, if you'll excuse me, I'm suddenly really hungry for avocado toast. It's just part of the job!

tl;dr Why Car Insurance is Pricey: Expensive Accidents: Repairs, medical bills, and lost wages drive up claim costs. Rising Healthcare Costs: Increased medical fees directly impact insurance payouts. Distracted Driving: More accidents due to distractions mean more claims and higher premiums. Costly Car Repairs: Modern, complex vehicles are pricier to fix. Factors Affecting Your Rate: Driving record, age, vehicle type, and location all play a role. Why is Car Insurance So Expensive? Car insurance is expensive. There's no getting around it. But why does it cost so much? The High Cost of Accidents One of the main reasons car insurance is so expensive is because accidents have become more expensive. When you get into an accident, there are a lot of costs involved. There's the cost of repairing your car has risen, the cost of medical care for you, any passengers, the other party and the cost of lost wages if they can't work. Insurance companies have to pay for all of these costs, which is why they charge high premiums. South Carolina is trending towards having higher rates. Let's do our part by driving safe to help reduce our costs. The Rising Cost of Healthcare The cost of healthcare is also on the rise, which is another reason why car insurance is so expensive. When you get into an accident, you or the other party may need to go to the hospital or see a doctor. The cost of these services is only going to continue to rise, which means that insurance companies will have to charge more for their policies. The Increasing Number of Distracted Drivers Distracted driving is a major problem, and it's only getting worse. When people are distracted while driving, they're more likely to get into an accident. This means that insurance companies have to pay out more claims, which drives up the cost of car insurance. Follow Us on Facebook The Increasing Cost of Car Repairs Cars are becoming more and more complex and not to mention safety technology, which means that they're also becoming more expensive to repair. This is another reason why car insurance is so expensive. There are delays in South Carolina body shops and supply chain disruptions. When you get into an accident, it can cost a lot of money to fix your car. How to Keep Your Car Insurance Costs Down There are a few things you can do to keep your car insurance costs down here in the upstate. One is to shop around for the best rates. At Select Source Insurance we do the shopping for you. You can also get discounts for things like good grades, safe driving, and having multiple policies with the same company and many others. The Bottom Line Car insurance is expensive, but there are a few things you can do to keep your costs down. Shop around for the best rates, get discounts, and drive safely. A Few More Things to Keep in Mind Your driving record: If you have a clean driving record, you're likely to get a lower rate on your car insurance. Check your record for claims and tickets to make sure you are not being charged for errors. Your age: Younger drivers typically pay more for car insurance than older drivers. Your car: The type of car you drive can also affect your car insurance rates. Sports cars and luxury cars are usually more expensive to insure than other cars. One myth is if you have a red car your rates will be higher. This is false. Your location: Where you live can also affect your car insurance rates. If you live in a big city like Spartanburg, you're likely to pay more than if you live in a small surrounding town like Lyman or Inman. In Conclusion Car insurance is a necessary evil, but it doesn't have to break the bank. By shopping around for the best rates, getting discounts, and driving safely, you can keep your costs down. I hope this blog article has been helpful. If you have any questions, please feel free to leave a comment below or reach out to us at 864-585-8318. If you would like to submit your basic information to our private local website, we will quote your rates with the most competitive companies available. We do not sell your information, it is completely secure. Get a Quote Here Additional Tips: Get quotes from multiple insurance companies. At Select Source we do that for you. Ask about discounts for things like good grades, safe driving, and having multiple policies with the same company. Drive safely. Maintain a clean driving record. Consider getting a higher deductible. Take a defensive driving course. Use a rideshare service or public transportation when you've been drinking. Will Car Insurance Rates Go Down Who has the Cheapest Car Insurance Maximize Your Groove With Discounts South Carolina DMV

TL;DR: The 3-Second Rule: Why It's Not Just a Suggestion (And Why You're Not Vin Diesel). Three seconds is NOT an eternity: It's the buffer you need to avoid turning your car into a metal pancake. "Pro" drivers are delusional: Physics doesn't care about your ego; it cares about stopping distances. It's simple: Pick a point, count "one Mississippi, two Mississippi, three Mississippi." If you pass it too soon, back off. Those seconds give you time to process, react, and let your car do its thing. Chill out, count, and avoid awkward insurance conversations. Driving isn't a race, it's a shared journey to avoid metal-on-metal crime. Three Seconds: The Eternity Between "Oops" and "OH NO." Alright, buckle up buttercups, because we're diving headfirst into the thrilling world of the three-second following distance. Yes, that glorious, often-ignored rule that separates us from a symphony of crumpled metal and insurance adjusters. Let's be honest, three seconds on the road feels like an eternity. Especially when you're stuck behind someone who seems to be navigating too delicately. You're thinking, "Come on, buddy, I could knit a sweater in three seconds!" But, alas, the highway safety supreme being (and your insurance premium) demand we adhere to this seemingly endless time gap. Both following too closely and texting while driving has added to the number of accidents in South Carolina in recent years. Ten Safety Tips for Driving in the Rain The "But I'm a Pro!" Delusion We've all been there. You're a driving ninja. You can parallel park in a space the size of a postage stamp. You know the exact moment to hit the gas to catch that elusive green light. You're basically Vin Diesel, but with a slightly less impressive car and a significantly less impressive physique. So, three seconds? Pfft. Amateur hour. And really, does arriving at your destination 3 seconds later matter? Avoiding the nightmare of claims is definitely worth it. Don't become a South Carolina accident statistic. "I can react in a nanosecond!" you declare, as you tailgate a semi-truck during a monsoon. "Three seconds is for people who can't tell the difference between a brake light and a Christmas tree." Spoiler alert: You're wrong. And you're about to learn a valuable lesson in the physics of large, metal objects, sudden stops and metal accordions. The Reality Check: Physics Doesn't Care About Your Driving Ego. Here's the thing: even if your reflexes are lightning-fast, your car isn't. It needs time to respond. And those three seconds? They're not just some arbitrary number a bored traffic engineer pulled out of thin air. They're a buffer. A safety net. A "Hey, maybe don't turn your car into a metal accordion" zone. The 3 second rule works for every speed whether you are traveling at 15 mph or 60 mph. Imagine this: the car in front slams on their brakes. Why? Who knows? Maybe a squirrel decided to audition for "American Ninja Warrior" by crossing the highway. Maybe they saw a particularly enticing roadside taco stand. Whatever the reason, they've stopped. Now, you have three seconds (or less, if you're a "pro") to react. Those three seconds give you: Time to process: "Wait, are those brake lights? Are they serious?" Time to react: "Okay, foot, move to the brake pedal! Now!" How much time does that take? I tried to calculate the time and it is slow. Time for your car to react: "Engaging anti-lock brakes! Please hold while I calculate the optimal stopping distance." Without those precious seconds, you're just a passenger in a metal projectile, headed for a very expensive collision. The Actual Technique (Because, You Know, Safety) For those of you who haven't memorized the driver's manual (and let's be honest, who has? I definitely have not.), here's the lowdown on the three-second rule: Pick a stationary object: A sign, a pole, a particularly grumpy-looking squirrel. When the car in front passes it, start counting: "One Mississippi, two Mississippi, three Mississippi." I slow this count also. If you pass the object before you finish counting, you're too close. Back off, buddy. Back. Off. The Moral of the Story: Chill Out and Count. Follow Us on Facebook Driving isn't a race. It's a delicate dance of metal, momentum, and the shared desire to get to our destinations without becoming a viral road rage video. So, take a deep breath, relax, and give yourself (and everyone else) a little space. Have you ever seen a stop light change to green and the car in front of you races to the next light. You can see clearly that the next light ahead just changed to red. Why are we racing to get to it? Also, if you are following too closely, and can't see what's in front of the car in front of you, be prepared for an accident. If the car in front stops suddenly or moves to another lane to avoid the stopped car in front of it, you won't have enough time to react and hit the stopped car. Several years ago, this happened to me. The 3 second rule works. Those three seconds might feel like an eternity, but they're the difference between a smooth ride and a very awkward conversation with your insurance agent. And trust me, nobody wants that. And besides that, it is less wear and tear on your car. Following to close, means using your brakes more often. I don't know if you have paid for a brake repair job lately, but it is not cheap. Can Car Insurance Drop You? What Does Car Insurance NOT Cover ? Top Ten Car Insurance Terms You Need to Know